Latest report by Videology finds cross-screen audience buying and measurement capabilities make Advanced TV the fastest growing advertising platform

Videology, the leading software provider for converged TV and video advertising, today announced the findings of a commissioned study conducted by Advertiser Perceptions on behalf of Videology on the topic of Advanced TV. The report, titled “Videology AdvancedTV Study 2017” identifies Programmatic as the major advertising category that will see more than 50% of total TV buying by 2018.

The programmatic marketplace is the most dynamic ecosystem in marketing and advertising industry today. As advertisers and publishers align their investment budgets to include programmatic head bidding solutions, the latest report by Videology should reinforce every CMO’s strategy to include the technology at the earliest.

Critical Observations Mentioned in Videology AdvancedTV Study 2017

Videology AdvancedTV Study 2017 is a Programmatic-enabler that is designed to evaluate how advertisers and agencies respond to Advanced TV advertising or programmatic TV advertising. To simplify the spectrum of programmatic within the report, Advanced TV was defined as both high-indexing linear TV that uses advanced data to define a strategic consumer target (known as data-enabled TV), as well as TV advertising delivered at the household level (known as addressable TV).

Defining Data-enabled TV (DETV), Address TV and Addressable/Programmatic TV

5 Ways CMOs can Include Programmatic for Video Advertising in 2017

Why Programmatic TV presents Fair Advertising Opportunities

Scott Ferber, Founder and CEO, Videology, says, “Advertisers and agencies are rapidly seeing the benefit of applying data and automation to their linear TV buys because it gives them the best of both worlds: the reach and viewing experience of TV, with the strategic targeting of digital.

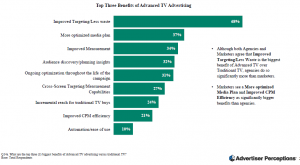

The numbers presented in the report also reflect the mood clearly —

- 10% advertisers believe that the biggest advantage of investing in Advanced Ad is its ease of use owing to automation technologies.

- 27% respondents identify Advanced TV helps in cross-channel targeting and measurement capabilities.

- 31% advertisers agree about real-time optimization throughout the campaign lifecycle.

- 68% respondents see improved targeting and better audience discovery which enhances incremental reach across channels. This is an assured ROI, owing to reduced waste and better CPM efficiency.

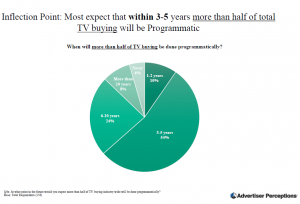

Programmatic at the Inflection Point

TV ad dollars is now holistically planned along with video budget. 61% of TV/Programmatic video buying is now regulated by a single integrated team. The teams are responsible for planning Data-enabled TV (DETV) and Addressable video budgets for the next 3 years. Most of these teams expect that within 3-5 years more than half of total TV buying will be Programmatic.

“Advanced TV in all its forms is growing, and it’s shifting the way advertisers and agencies do business. I expect these changes to continue to grow at a rapid pace, including shifts in this year’s Upfronts,” said Andy Sippel, SVP, Consulting, Advertiser Perceptions.

Additionally, among those currently spending in Advanced TV, 57% say they plan to increase their data-enabled TV budgets this year.

Need more Clarity on Marketplace for Advanced TV

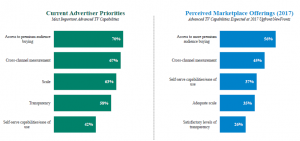

At least half the respondents acknowledge that advertisers and publishers are yet to clearly understand the difference between DETV and Addressable inventories. The report identifies the challenges that advertisers face in deciding premium audience buying, cross-channel measurement analytics, quality, and scalability.

Understanding the Programmatic marketplace provides a big opportunity to Supply-Side Platforms in responding to advertisers’ demand for high-quality premium ad inventory with excellent viewability. This is largely based on clearly defined audience-based buying campaigns.

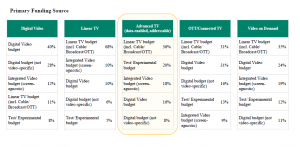

Investments into Integrated Video Platforms are Rising

Digital video and Over-the-Top solutions with programmatic TV take the highest piece of budget allocation. It is interesting to see Test/Experimental budgets contribute 20% of the funding to Advanced TV.

53% advertisers admit about increasing their planning budgets for Addressable TV; still lagging behind DETV planning budgets.

Advertisers Expect Advanced TV to Deliver More Cross-Channel and Audience Measurement Capabilities by 2018

Successful investment into Advanced TV planning relies on cross-channel capabilities. Nearly one-fourth of the respondents agree about the importance of cross-screen capabilities while evaluating Advanced TV.

Close to 70% respondents identify access to premium audience buying and cross-channel measurement as the most important Advanced TV capabilities. Scale, transparency, and self-service capabilities are secondary to audience buying and analytics.

Advanced TV versus Linear TV: The Advertising Battle Hardens Up

According to the survey, Advanced TV is the fastest growing among TV advertising types, with the same percentage of respondents planning to use Advanced TV next year as those who plan to use traditional TV advertising:

- 57% say they have used Advanced TV advertising in the past 12 months, while 75% say they plan to in the next 12 months

- 88% say they have used linear TV advertising in the past 12 months, with 77% saying they plan to in the next 12 months

Advanced TV Moves on an Accelerated Path

The survey shows that when it comes to planning and buying video advertising, holistic thinking across TV and video is becoming the norm —

- Today, 31% of TV/video campaigns are planned holistically, and respondents predict that by 2018, this number will jump to 44%

- 55% say they prefer to learn about both digital and TV opportunities at the same “Upfront” events (i.e., the lines between traditional Upfronts and NewFronts continue to blur)

Ferber adds, “While this survey focused on the demand side, we are seeing similar enthusiasm from media companies who see data-enablement as a way of capturing greater value from their audiences, both in TV and across devices. With buyers and sellers both recognizing the value in more addressable, audience-based advertising, the marketplace can now truly accelerate.

Despite the unmistakable growth suggested by this survey, it was also clear there is still education needed surrounding Advanced TV:

- More than half (57%) of advertisers and agencies say they do not understand the difference between data-enabled TV and addressable TV

- 20% say that Advanced TV advertising is still funded primarily from a Test/Experimental budget

For businesses looking to monetize their Live streaming content, programmatic delivers a very healthy revenue model. By deploying programmatic video solutions in live streaming content, marketers can deliver better user experience with excellent personalization. Something that traditional TV can never provide compared to online live streaming.

MarTech Series carries an exclusive Programmatic TechBytes for Video Advertising Solution providers, including DSP & SSP, OTT and more. Do you want to participate? Mail us at sghosh@martechseries-67ee47.ingress-bonde.easywp.com or news@martechseries-67ee47.ingress-bonde.easywp.com